Property insurance is topic of community conversation

Published 6:23 am Tuesday, October 29, 2019

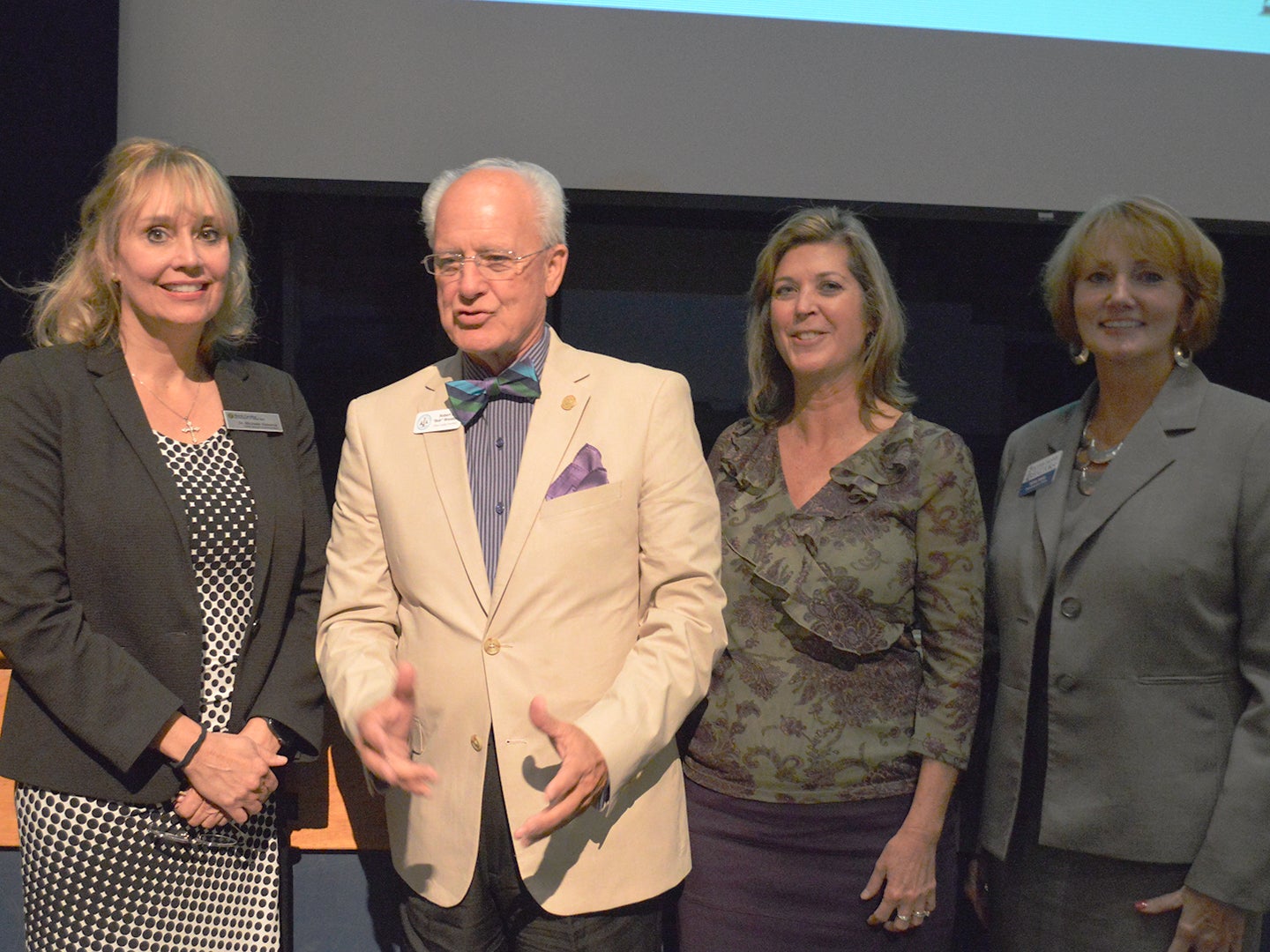

- Speaking at the Community Conversation about Property Insurance are Michelle Osborne, left, chief deputy commissioner, North Carolina Department of Insurance; Robert L. Woodard, chairman, Dare County Board of Commissioners; Donna Creef, Dare County planning director; and Willo Kelly, chief executive officer, Outer Banks Association of Realtors. Mary Helen Goodloe-Murphy photo

For almost two hours, citizens, real estate agents and insurance agents listened to three powerful speakers talk about property insurance, current concerns and complications.

The Community Conversation about Property Insurance, sponsored by the Outer Banks Association of Realtors, drew about 100 people to First Flight High School on Tuesday, Oct. 22.

Headlining the event was Michelle Osborne, chief deputy commissioner of the North Carolina Department of Insurance.

When Hurricane Florence hit the state, the Department of Insurance found that 1.9 million flood insurance policies were needed. Some 34 towns were not part of the National Flood Insurance Program and could not receive disaster assistance. Since the hurricane, one town joined up.

The department is now working on a new flood policy to be offered through the private insurance market, said Osborne. The North Carolina Rate Bureau, which represents insurance companies issuing insurance in the state, has proposed a new filing that matches price to risk and allows individual companies to offer private market flood insurance.

One of the advantages of opening a private insurance market for flood is the ability to regulate some portion of that market.

Osborne explained that two forms of property insurance are offered in the state: HO-3 and dwelling.

She warned that a dwelling policy is not a comprehensive policy. Though it may be less expensive, “it may not provide the best coverage,” reported Osborne in her presentation. For example, wind-driven rain is not covered on a dwelling policy.

Osborne said “wind driven rain is a real problem.”

Damage from rain entering through an opening caused by a windstorm is covered under a wind and hail policy or homeowners policy. It is not flood damage.

The definition of flood in the insurance world is “a general and temporary condition where two or more acres of normally dry land or two or more properties are inundated by water or mudflow.”

A HO-3 policy is not perfect. It does not automatically cover loss of refrigerator or freezer contents. The policyholder needs to ask for an endorsement.

In addition to Homeowners Standard Policy, HO-3, with endorsements, wind and hail policy and flood policy (required on all federally insured mortgages), an umbrella policy is recommended.

Another matter of concern to the department is consent to rate, which was covered extensively by the second speaker.

Willo Kelly, Chief Executive Officer, Outer Banks Association of Realtors, outlined the 3 Ds for property owners: declaration page, dwelling value and deductible.

On the declaration page, the first page in the policy packet, may be a disclosure about consent to rate. Prior to Jan. 1, 2019, insurance companies were required to have a form signed by the property owner to apply consent to rate.

Now, the disclosure statement on all new or renewed policies or endorsements is required on the declaration page, or a separate page in front of the declaration page, when the premium charged is higher than the premium based on the rate approved by the Department of Insurance. The change was the result of legislation passed by the General Assembly in 2018. The legislatively stipulated notice states:

“Notice: In accordance with G.S. 58-36-30(b1), the premium based upon the approved rates in North Carolina for residential property insurance coverage applied for would be $____. Our premium for this coverage is $_____.”

The increase cannot exceed 250 percent of the approved rate.

If a consent to rate notice appears, “call your agent,” said Kelly.

An independent agent may be able to find another policy that doesn’t have consent to rate. If the policy is with a carrier like Nationwide, State Farm or Farm Bureau, the agent may be able to work on deductibles and policy type or find a policy without consent to rate.

Dwelling value must be accurate and the policy include rebuilding costs.

Deductible is based on the dwelling value.

“Low risk is not no risk.”

That’s the phrase used by Donna Creef, Dare County planning director and advocate for flood insurance and the community program that goes with it.

The long-awaited new flood maps will be adopted effected June 2020.

The maps show hundreds of properties in Dare County coming out of flood zones and receiving a shaded X or X zone designation.

“We are concerned about that in Dare County,” said Creef, reporting that one out of four flood insurance claims are in X zones.

Property owners in X and shaded X zones need to carefully check that flood insurance is not automatically cancelled. Creef said that it is easier to modify an existing policy than to write a new one.

The Community Conversation about Property Insurance was sponsored by the Outer Banks Association of Realtors and supported by the association’s community partners: Banker’s Insurance, Elite Insurance and Steven Gillis State Farm Agency.

READ ABOUT MORE NEWS AND EVENTS HERE.

RECENT HEADLINES:

Mikel Brady sentenced to death for Pasquotank Correctional murders